.webp?width=900&height=442&name=Depositphotos_482343516_XL-1-1%20(2).webp)

The Securities and Exchange Commission (SEC) has introduced a new rule that significantly impacts the settlement process for popular equity plans offered to employees, such as stock-settled Restricted Stock Units (RSUs) subject to tax withholding, and stock option/stock appreciation right exercises involving same-day sales. Effective May 28, 2024, the settlement cycle will be shortened from two business days after the transaction date (T+2) to one (T+1).

While reducing settlement timing is a step towards mitigating risk for investors and enhancing market efficiency (per a recent SEC press release), this 50% reduction in turnaround time underscores the necessity for companies to leverage technological advancements that enable accurate and near-instantaneous processing of equity transactions.

One critical aspect of the T+1 settlement cycle that companies must address is the tax implications. Not only do the equity transactions themselves need to be processed swiftly and precisely, but the associated tax reporting, withholding calculations, and deposits must also be expedited to comply with the new timeline.

Companies of all sizes face the challenge of modifying their settlement processes to accommodate T+1. While this may seem daunting for those who haven't yet explored solutions, it is a manageable undertaking with proper planning and execution. This article provides a roadmap for effectively managing tax aspects of the T+1 settlement cycle, with a focus on streamlining the process for mobile employees participating in equity plans.

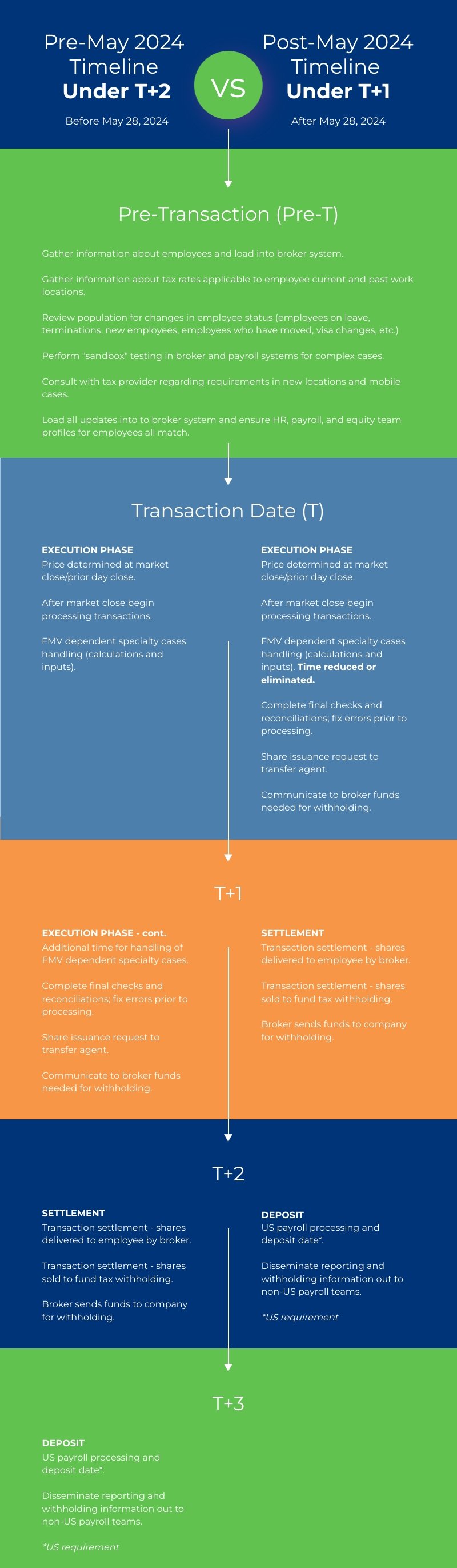

From T+2 to T+1: Visualizing the shift in settlement timelines

To fully grasp the implications of the T+1 settlement rule, it's essential to understand the timeline compression compared to the previous T+2 settlement cycle. This visual representation highlights the key differences between the two settlement periods, underscoring the accelerated pace required to meet the new regulatory requirements.

Accelerating settlement for same-day sale exercises and sell-to-cover RSUs

It's important to note that the T+1 settlement period is required only for open-market transactions and does not apply to transactions between the company and employees, such as net exercises of stock options and share withholdings on RSUs. However, many companies are proactively aligning their processes to meet the T+1 timeline for all equity transactions, including those involving employees. This streamlined approach ensures consistency and helps mitigate potential complexities arising from different settlement cycles.

For equity compensation plans that permit same-day sale exercises of stock options or stock appreciation rights, as well as sell-to-cover transactions for RSUs, the T+1 settlement cycle necessitates a significant acceleration in processing times. Companies will need to implement robust mechanisms to ensure that tax withholding calculations, reporting requirements, and deposits are completed within the condensed one-business-day window following the transaction date.

The compression of the settlement timeline poses unique challenges for companies with globally mobile employees. Cross-border payroll reporting and multi-jurisdictional tax calculations add layers of complexity that must be navigated to meet the T+1 deadline. Failure to comply with the expedited settlement requirements could result in operational disruptions, regulatory consequences, and potential reputational damage.

Addressing mobile employee complexities: The case for automation

Envision the most challenging aspects of your company's settlement process. For many organizations, handling RSU settlements and stock option exercise transactions for their mobile employee populations ranks near the top. The complexities associated with adapting the T+1 settlement process to accommodate mobile employees are compounded by the growing size of this population due to the increased popularity of remote and hybrid work arrangements.

If you haven't reviewed the true scope of your mobile employee population within the past 12 months, now is an important time to reassess. Understanding the accurate size and complexities of this group will enable you to make more informed decisions about the changes required to implement T+1 compliance. Identifying the number of mobile employees and their geographic locations will quantify the tax reporting and withholding exposure risks, rather than relying on vague estimates.

Once you have a clear picture of your mobile employee population, you can prioritize the most material areas and quantify the potential exposure in terms of underreported or underwithheld taxes. For guidance on evaluating your mobile population, refer to this resource: https://www.gtn.com/blog/your-roadmap-to-ensuring-mobile-equity-compliance.

To address the unique processing challenges posed by mobile employees, many brokers now offer modules or application enhancements that can be configured by the company to assist with settlement processing and ensure appropriate tax withholding across multiple jurisdictions. While these solutions can be helpful, it's important to remember that they are often limited in functionality, and brokers are prohibited from providing tax advice. With that, the responsibility lies with the company to ensure accurate interpretation of tax reporting and withholding requirements across all applicable jurisdictions, including countries, states, provinces, and local/city taxes.

Companies must also possess a understanding of the functional interactions between various tax rules across jurisdictions to ensure correct system-generated results, proper reporting, and accurate withholding in multiple foreign country payrolls for transactions involving international mobile employees. This may involve interpretation and application of tax positions, treaties, and global tax regulations.

Furthermore, companies are responsible for ensuring correct income reporting across all jurisdictions and resolving instances where income reporting differs from the income allocation used for tax withholding calculations. At a minimum, retaining a knowledgeable mobility tax expert who understands the intricacies of mobility tax and equity transactions' nuances is crucial.

Alternatively, for companies with limited mobility expertise, introducing automation may offer a well-balanced solution to bring their processes into the T+1 era. If calculations for mobile employees are currently handled manually, such as through Excel spreadsheets, it may no longer be feasible to continue this approach within the constraints of T+1, even for relatively small populations. Scalable solutions that can integrate with existing broker and payroll systems may be available at a cost aligned with your budget needs.

Navigating next-day tax deposit requirements

It's important to distinguish the SEC's T+1 settlement rule, which shortens the time frame for settling shares into an investor/employee's account, from the IRS's next-day deposit rule. While the T+1 rule directly impacts stock plan administrators, the next-day deposit rule primarily affects payroll and treasury teams but has indirect implications for equity compensation administration.

The next-day deposit rule stipulates that if an employer accumulates $100,000 or more in taxes on any day during a deposit period, the taxes must be deposited by the next business day after reaching the $100,000 threshold. While a comprehensive discussion of this topic warrants a separate article, it's essential to factor this requirement into your award processing workflow if it hasn't been addressed already.

To manage the next-day deposit rule effectively, many companies calculate an estimate (or over-estimate) of the tax liability. This approach allows for any overpayment to be trued up or refunded later, ensuring compliance with the deposit timeline without disrupting operations.

For more information on the next-day deposit rule, refer to the following IRS resources:

By proactively addressing the next-day deposit requirements alongside the T+1 settlement changes, companies can ensure a seamless transition to the accelerated timeline while maintaining compliance with tax regulations.

Key process enhancements for streamlining equity plan administration

In addition to understanding the roadmap for T+1 equity settlement compliance, it is important to take steps to make sure your organization’s policies, procedures and process are ready to support the accelerated compliance timelines. Here are three key areas for organizational review:

Revisit your compliance policies and procedures

Withholding Method

Since the T+1 rules are applicable only to open-market transactions, companies are considering a shift from the sell-to-cover withholding method to net share settlement/withhold-to-cover. This change would require companies to have readily available cash reserves to fund the shares withheld for tax purposes and obtain approval from the compensation committee/board.

Withholding Rates

Another practical adaptation for equity teams managing mobile populations is to establish an all-encompassing tax rate or a specified effective tax rate for each mobile employee. However, companies must ensure that the selected tax rates are appropriate and that the resulting transactions are processed correctly via payroll. A potential drawback of this approach is the limited bandwidth within the short T+1 timeframe to ensure technically correct payroll reporting, potentially necessitating double tax withholding to meet the processing deadline and US payroll deposit requirements. It's worth noting that countries like India and Canada, and several countries within Europe, are also moving towards adopting T+1 processing standards, further reducing the available time frame on a global scale.

For transactions not involving the US or Canada, there may be more time to reconcile country-specific reporting and process withholdings; however, this requires additional administrative effort. Many mobility tax consultants offer automated solutions that not only accelerate processing times but also reduce the administrative burden associated with mobile equity transactions. However, while these automated and scalable solutions are available to companies of all sizes, including small to mid-sized organizations, it is important to find a provider that offers a flexible, cost-effective approach that aligns with the experience and outcomes needed for your organization.

Fair Market Value (FMV)

To alleviate the strain of the shortened cycle, companies may consider updating procedures to use the FMV based on the prior day's closing price. This change would also require approval from the compensation committee/board. It's important to remember the definition of FMV may differ across countries based on local regulations.

By proactively evaluating these process updates and implementing appropriate solutions, companies can navigate the T+1 settlement cycle while ensuring compliance and efficient administration of their equity compensation programs for mobile employees.

Collaborate and communicate with key stakeholders

Navigating the transition to the T+1 settlement cycle requires close coordination among various internal and external stakeholders. Effective collaboration and clear communication are essential to ensure a smooth implementation process and minimize disruptions to your equity compensation program.

Internally, this endeavor demands the involvement of cross-functional teams, including IT, legal, compensation/benefits, HR, payroll, treasury, tax, and finance. Each team plays a crucial role in ensuring that the necessary system updates, process changes, and compliance requirements are addressed comprehensively.

Externally, you'll need to engage with key partners such as brokers, transfer agents, legal advisors, and tax and mobility consultants. Their expertise and support are invaluable in implementing the required changes, maintaining regulatory compliance, and addressing any complexities arising from your global mobility program.

Moreover, it's crucial to keep your employees informed throughout this transition. As the end-users of your equity compensation program, they should be aware of the upcoming changes and how they may impact their equity awards and transactions. Clear communication can help mitigate confusion and ensure a seamless experience for your workforce.

Leverage expertise and explore innovative solutions

Effective collaboration and open lines of communication among all stakeholders are paramount to successfully navigating the T+1 settlement cycle. By fostering a collaborative environment and leveraging the collective expertise of your internal teams and external partners, you can proactively address challenges, streamline processes, and maintain compliance while minimizing disruptions to your equity compensation program.

As you navigate the path towards the T+1 processing deadline, leveraging the expertise of mobility tax advisors is paramount.

Whether you have a meticulously crafted plan in place or are still determining where to begin, GTN's equity experts are ready to be your trusted partner. Our team would be delighted to discuss your unique needs and provide a complimentary consultation on how we can help you achieve T+1 readiness while ensuring compliance and efficient administration of your global equity compensation program.

To schedule a free consultation and explore how GTN can support your T+1 implementation efforts, please contact us today.