As the future of work continues to evolve, providing a “positive employee experience” is top of mind for companies. While some organizations have gone back to in-office working arrangements, many have retained a full or partial remote workforce culture. These businesses see the provision of a flexible workplace as critical to not only retaining key employees, but also in recruiting top talent to fill essential job duties. And while this incentive is a benefit for the employee and employer, there are important duty of care responsibilities that need to be considered when you have a remote workforce.

In a recent Work Anywhere Pulse Survey we conducted alongside some of our cooperating vendors, an average of 38% of respondents stated that at least a portion of their organization will continue working remotely permanently. Another 24% said they are either working through the decision or expect a mix of temporary and/or permanent remote workers.

Many companies understand the employee risks associated with more traditional forms of mobility, such as long-term assignments and permanent transfers. For these, they may provide tax and immigration support to make sure the employee remains tax compliant with Home and Host country legislation. But, in this new world of stay-at-home workers, what should companies consider in determining their level of employee support?

Below we outline how these changes impact an employer’s duty of care, highlight areas of tax risk for remote workers, and provide a framework for moving forward in developing an appropriate remote workforce policy for your organization.

How do new changes in the workplace affect an employer’s duty of care?

As employers decide the amount of support they will provide to their employees, they must consider duty of care—the legal and ethical obligation that employers have to ensure the health, safety, and well-being of their employees.

Some examples may include:

- Local-level health and safety regulations (e.g., OSHA in the US)—either with a US state or another country

- Workers’ compensation coverage

- Other personal regulatory compliance, such as immigration and tax compliance

Prior to the shift to more remote work structures, most organizations would provide company support for an employee who was traveling for business and not for an employee who was primarily traveling for personal reasons but decided to work while traveling. However, with remote work quickly becoming the norm, the line between work and personal time has become less obvious and employers must consider how it impacts the duty they have to their employees.

Duty of care has a very broad definition (health, safety, and well-being of employees) and different companies may have different ideas on what this means in terms of employee support. Here are some questions that should be considered when deciding the amount of support to provide to an employee who is working remotely or simply not working from their typical office location:

- How will you and other stakeholders within the company be made aware when the employee is no longer working from their typical office location?

- What type of job duties is the employee performing?

- Are there local-level health and safety laws that must be considered?

- Will the company reimburse travel to the office for necessary meetings, and to what extent? What if flights are required?

- Will company health insurance plans cover a new location the employee is working in?

- Are there any special data privacy and security requirements that will need to be considered due to a remote work location?

- Will compensation be adjusted if the employee permanently moves to a new location with a higher or lower cost of living?

- Will any immigration paperwork need to be submitted due to the employee’s remote work location, even if it is only temporary?

- Where should unemployment insurance and workers compensation be paid? Are there other employment law considerations?

- How will the company track employee travel to ensure payroll accurately reports income in jurisdictions where work is being performed?

- If tax returns need to be filed in a new location, will the company assist the employee, or at least notify them of their obligation?

- Will the employee’s work/physical presence in the remote location create additional corporate reporting or tax obligations for the company?

- Are there home office expenses the company will reimburse for such as cell phone/landline, desk, internet, printer, or other office equipment? Are there any tax or policy considerations for the company or employee relating to the provision of this equipment?

Company and employee tax risks in a remote workplace culture

When employees hear the term “remote work,” they understand and appreciate the flexibility it allows by providing them with an ability to work from anywhere. This makes it easy for an employee to travel to a different location and still perform their job duties. It is then the employer’s obligation to know where their employees are so they can address issues that arise from working outside of one’s typical office location.

Below are two client case studies to illustrate this from a tax perspective:

Case study 1: Jim learned that his company, located in California, will allow employees to work remotely for extended periods of time. Due to this, Jim decided to travel to his home state of Wisconsin to spend time with his parents. He is taking full advantage of the ability to work remotely and will stay with his parents for several months. Jim’s manager is aware of where Jim is working but has not contacted the company’s global mobility team because Jim is still working within the United States. Since Jim will still be filing a resident return in his home state of California and reporting all wages, the assumption is that there are no issues.

What the company has not taken into consideration is that both Jim and the company may face significant issues in this scenario, such as:

- Changes to income tax and withholding obligations

- Nexus risks for the company in Wisconsin (i.e., state taxable corporate presence)

- Issues with health insurance and other benefits

Case study 2: Sunita traveled to her Home country of India in April 2022 to visit family. She originally intended to stay for a few weeks and was scheduled to return to the US mid-May. However, due to family matters, Sunita asked her manager if she could extend her stay in India through the summer and possibly through the end of the calendar year. Sunita’s manager wanted to be supportive and saw no issues as Sunita would still be able to perform her work duties as normal. Sunita is a citizen of India and therefore did not need a business visa, so the assumption was there would not be any issues.

What the company has not taken into consideration is that both Sunita and the company may face significant issues in this scenario, such as:

- Additional income tax and withholding obligations

- Permanent establishment (PE) risks for the company (i.e., creation of taxable corporate presence in India)

- Benefit and employment law considerations

These issues often stem from the fact that each stakeholder within a company often does not have visibility into where their employees are working from. This in turn creates significant challenges for employers in terms of compliance and in deciding how much support they will provide to an employee.

How do you build a policy framework to enable duty of care for global tax compliance?

When building a policy to address remote workforce risks for your organization, it is important to understand the issues your company and employees may face. As illustrated in the above case studies, there are many risks associated with remote work, and organizations will have different views on their duty of care responsibilities for their employees and on the level of risk tolerance for the company.

In reviewing these case studies from a tax and payroll perspective, Jim or Jim’s manager (Case study 1) should have notified the company payroll team to let them know about his temporary work location.

Once payroll had been notified of Jim’s situation, the following must be considered:

- Analysis of the income tax and withholding laws of Wisconsin. Different states within the US have different regulations for when withholding is required. Some are required from the first day of working in the state, and others may have an income amount or days threshold.

- The corporate tax team should review if there are any nexus risks based on the work that Jim is performing.

- The benefits team should check that Jim’s health insurance is accepted in Wisconsin and that there are no other local employment law considerations.

- Jim will need to provide travel data to payroll so they can accurately report his wages in both California and Wisconsin.

- If Jim is working in the US under a visa, immigration attorneys must be consulted to make sure no additional paperwork is required.

As outlined in Case study 2, Sunita’s situation is more complex, especially since it involves another country. Once it was known that Sunita was prolonging her stay in India, the global mobility team should have been notified.

Once notified, the company must take the following into consideration:

- Analysis of the income tax and withholding laws of India. Many people are familiar with the basic “183-day rule” found under many US income tax treaties. Here, the extension of her trip could cause Sunita to go over this threshold as defined in the US – India income tax treaty. It will be important for Sunita to carefully monitor her travel and for the company to understand all the requirements needed under the treaty to achieve an exemption from India income tax.

- It is important to note that some countries will require income reporting and tax withholding even if a person has not been there for 183 days and even if an exemption from ultimate tax does apply under a treaty.

- It also important to note that physical presence is not the only factor to consider in determining if a treaty may be applied to exempt an individual from taxation, so it is important to review the specific treaty terms for every unique scenario.

- The corporate tax team should review if there are any PE risks based on the work that Sunita is performing. The duties of her job can affect the risk of not only her being taxed in India, but the company being taxed there as well.

- Sunita’s US health insurance may not be accepted in India so the benefits team should consider whether she should be placed on an international health insurance plan for the time she remains there.

- Sunita will need to provide travel data to the payroll and corporate tax teams so they can accurately determine the tax reporting and withholding positions. The company may have to determine what steps are needed to allow for compliance with any tax reporting and withholding requirements.

- Since Sunita has gone back to her birth country, there should be no immigration issues. However, if she was visiting family in a country where she does not have citizenship, immigration attorneys must be consulted to see if work permits are required. The company should not assume that there are no immigration issues just because their employee is visiting family.

Once you understand the issues, it is important to establish a process to track where your employees are working and to clearly communicate employee responsibilities in managing this process. Even if your company does not plan to implement a full remote workforce policy, there should be clear guidelines provided to all managers as well as employees so you can maintain consistent treatment throughout your workforce. It is important to make sure your employees understand what remote working does and doesn’t mean, and what level of support will and will not be provided.

Download our webinar How to Establish a Global Remote Work Approval and Tracking Process to gain insights into building the business case internally for remote work and how you can develop and implement policies for ongoing management.

It is also important to make sure your employees understand what their obligations are. In our Work Anywhere Pulse Survey, 51% of companies said they expected their employees to self-report where they are working from.

![]()

Employees are not always aware when they need to report their travel. As highlighted in the case studies above, you could have multiple employees spending extended time away from their typical tax jurisdiction but continuing to file in their Home location, unaware that they should report this new location to anyone. To ensure company awareness and compliance, employees need to understand what should be reported, who they should report it to, and when they should report it. One way to assist with this could be to increase your global mobility team. This way, employees have access to resources and guidance from individuals that are familiar and experienced in this area and who can help keep them compliant with laws and company policy.

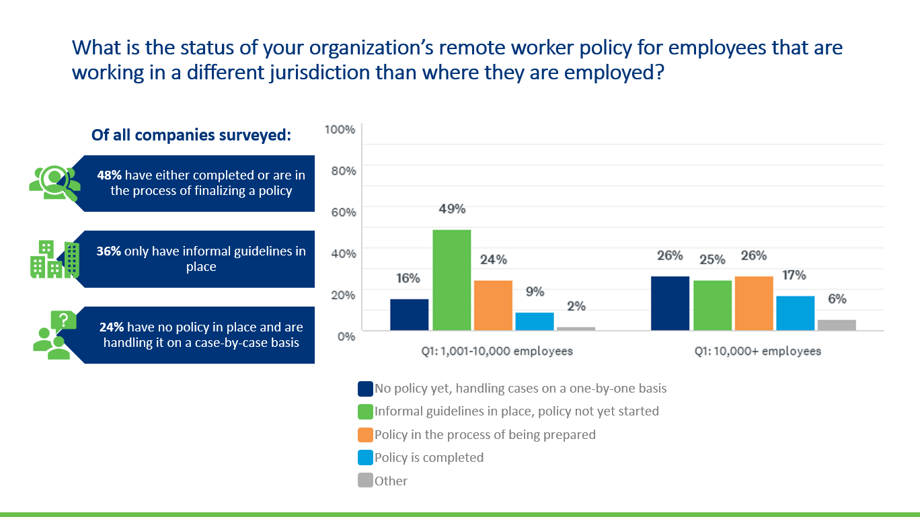

Once you have determined the best way for your organization to identify who is working remotely, it will be important to properly document the guidelines and procedures in a policy. In our Work Anywhere Pulse Survey, 36% of companies have either completed or are in the process of finalizing a policy in this area. GTN has developed a Compliance Checklist for a Remote Workforce to assist companies as they develop their remote work policy.

Finally, once you have drafted appropriate guidelines or a policy, it is critical that you communicate them to your employees and set up procedures to allow for review and approval of new cases. Without enforcement of the policies, your organization will not be able to meet its own obligations and will not meet the appropriate duty of care standards.

Ultimately, your obligation as an employer is to ensure duty of care for your employees and to understand and meet any tax and legal obligations for the company. Following these steps can help your organization meet these objectives:

- Understand the key issues to consider

- Determine the best way to track employee travel and share with all internal stakeholders

- Develop a policy and guidelines, then communicate and enforce the policy with all employees

A change in workplace culture leads to natural changes in policies and obligations. We often help companies understand and build policies around the global tax implications related to duty of care. Schedule a call with our team to discuss how we can help.