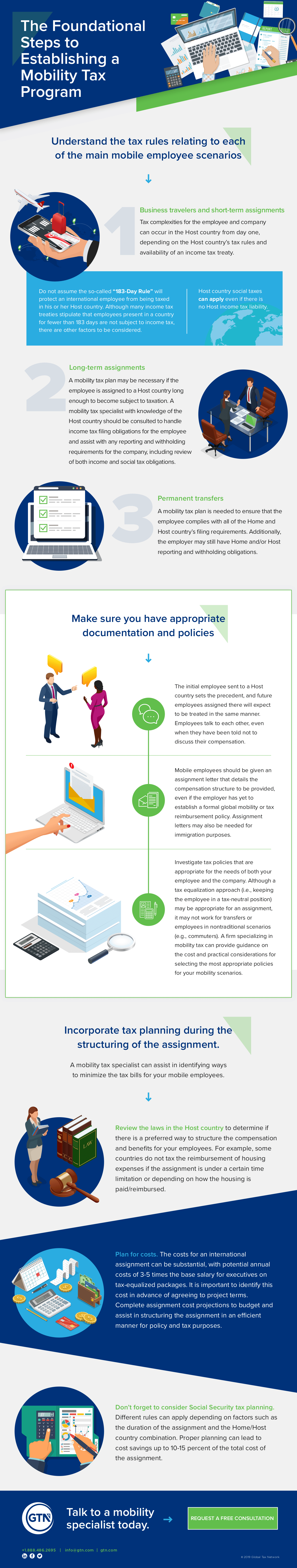

It’s important for global companies of all sizes to be aware of tax obligations whenever an employee crosses a border. Remembering to check into possible tax exposure is critical to ensuring your employees are informed and to allow your company to mitigate potential risks. There are three common mobile employment scenarios that your company should understand and be prepared to handle.

Three Common Mobility Tax Scenarios

The following are common mobile employee situations for mobility tax programs you should address:

-

Business travelers and short-term assignments: Tax obligations may apply to both the employee and company beginning from day one in the Host location, depending on several factors, including the Host location’s tax laws, applicability of income tax treaties or social security totalization agreements, and/or the length of the employee’s presence in the Host location. Additionally, the frequency of recurrent travel to the same location could affect reporting and tax treatment of items that otherwise are generally considered business expenses.

-

Long-term assignments: A mobility tax plan may be necessary if the employee is assigned to a Host location long enough to become subject to taxation. Depending on tax laws in the Home and Host locations, it may be possible to structure compensation and benefits in a way to lower the tax bill or avoid double taxation.

-

Permanent transfers: For companies, it is important to understand Home and Host country payroll reporting and withholding requirements for employees who transfer employment from one country to another, especially for those who participate in equity or RSU/RSA award plans. A mobility tax plan is also needed to ensure that the employee understands and complies with the Home and Host country’s filing requirements.

What considerations should you keep in mind as you develop your policies and procedures? What ways can you minimize the tax surprises for your mobile employees and for the company? How can a mobility tax specialist help you navigate through this complex tax landscape?

Check out the infographic below to find out: