In recent years, the global workforce has witnessed a significant shift towards remote work and the rise of digital nomads, defined as a person who works entirely over the internet while traveling and who has no fixed place of business. As more individuals seek the freedom to work from anywhere in the world, many countries have recognized this evolving trend and responded by offering a unique solution—the “digital nomad visa.” This visa, often with less stringent requirements than traditional work visas, allows individuals to live and work in worldwide destinations of their choosing.

While obtaining the digital nomad visa takes care of the immigration requirement to enter and work in a country for a specified period, it typically does not relieve the individual from income tax and/or social security exposure, or the employer from payroll considerations. In this article, we’ll explore the world of digital nomad visas, offering a comprehensive guide for human resource and mobility program managers. We'll cover the countries that now embrace this concept, delve into the complexities of income and social security tax implications, and shed light on corporate tax considerations employers must navigate.

Countries Offering Digital Nomad Visas

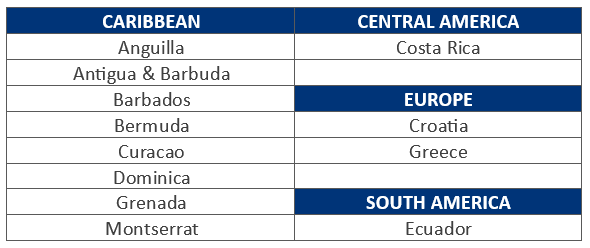

The global map of digital nomad visas is expanding, offering remote workers and globetrotters an array of exciting destinations. Here is a list of some of the many countries which offer digital nomad visas. The list is not intended to be exhaustive and professional immigration advice should always be sought before working outside one’s Home country.

Navigating Income Tax Considerations for Digital Nomads

As a digital nomad, the allure of working from picturesque destinations around the world is undeniable. However, it's essential for your employees to be well-versed in the income tax implications, including ways to legally avoid income tax on earnings in their Host country while on a digital nomad visa. Here are the key factors that must be considered.

Income Tax Treaties

One way to legally minimize income tax liability in the Host location is by exploring tax treaties. These treaties exist between the employee’s country of residence and the Host country and may exempt them from local income tax if certain conditions are met. Typically for an employee, this exemption applies when they spend fewer than 183 days in the Host country within a specific period (i.e., fiscal year; calendar year; or any 12-month period beginning or ending in the fiscal year) and remuneration costs are not borne by or recharged to an entity or permanent establishment which the employer has in the Host country.

It is important to consider your specific tax scenario and the wording of the conditions within the specific treaty to determine if qualification for any treaty relief is applicable.

Visas

Another way to legally minimize income tax liability is through a visa. It's important to note that not all countries offering digital nomad visas grant full or partial exemptions from income tax. As of now, a select few countries offer income tax relief to digital nomads. This list is not exhaustive and is subject to change but some of the countries currently include:

Understanding the specific terms and conditions of the digital nomad visa in an employee’s chosen destination is crucial. Without the right visa, they may still be subject to income tax in the Host country.

Understanding Social Security Implications

The social security exposure of working remotely in a foreign country under a digital nomad visa is often overlooked yet can have a significant impact on the financial well-being of your employees. Social security agreements, also known as Totalization Agreements, between the Home and Host countries, are designed to ensure individuals don't double-contribute to social security systems, protecting their benefits and rights. In the absence of such an agreement, employees may fall under the default rule, under which social security contributions are due in the country where they are working. This can affect both their personal contributions and those made by their employer, potentially leading to dual obligations and a reduction in take-home income.

Payroll Withholding and Advance Tax Payments

Having considered the possible income tax and social security obligations for the employee at a high level, the next step is understanding the potential complexities with settling liabilities. We'll use Brazil and Argentina to illustrate:

Brazil – Advance Tax Payments

Brazil does not grant income tax exemptions to digital nomad visa holders. It has ratified double tax treaties with several countries, with some notable exceptions including the United States, the United Kingdom, and Germany. The digital nomad visa is valid for 12 months with the option to renew for an additional 12 months. So even individuals from countries that have entered into a tax treaty with Brazil would not be able to exempt their Brazilian source income from Brazilian taxation under the dependent personal services clause if they are physically present in Brazil for 183 days or more (during the year or as specifically defined in the applicable treaty).

With that background and assuming the individual is paid through a foreign payroll, no income tax withholding is due but payments of “advance tax” locally known as “carne-leao” are due monthly. This advance tax requires registration with the Brazilian Revenue Receita Federal and completion of a monthly “DARF” form together with monthly electronic remittance of the taxes due.

To further complicate matters, assuming the individual remains on Home country payroll, some countries will not allow a reduction in Home country withholding even when foreign withholding is due on the foreign source portion of total income. For example, the IRS allows such a reduction in respect of US citizens who are subject to mandatory foreign withholding and may not consider advance tax payments, as in the case of Brazil, withholding. Even if a foreign tax credit is ultimately allowed in the US, the cash flow impact of US withholding and Brazilian advance tax payments on the same income can be onerous.

Argentina – Withholding

Like Brazil, Argentina does not exempt digital nomad visa holders from income tax.

A non-resident individual holding a digital nomad visa in Argentina is subject to withholding on Argentinian source income. As of the time of publication, if the individual is paid through a foreign payroll in Argentina, 70% of their total earnings are deemed Argentinian source income, subject to a tax rate of 35%, resulting in an effective tax rate of 24.5% on total earnings.

Unlike Brazil where the individual is responsible for paying the tax, the obligation to remit Argentinian withholding taxes falls on the employer. This means the foreign employer must register with the Argentinian tax authorities and ensure withholding taxes are paid promptly and in local currency.

Corporate Tax Considerations and Permanent Establishment

While offering employees a digital nomad lifestyle presents opportunities for flexibility and global experiences, it also raises important considerations for employers. Corporate tax and the concept of establishing a permanent presence in the Host country are paramount issues that demand attention.

From a corporate tax perspective, it’s essential to evaluate the nature of the duties undertaken by the employee while working in the Host country. This analysis is critical to ensure that a permanent establishment of the Home country entity isn’t inadvertently created in the Host country.

A permanent establishment can have far-reaching implications. In a worst-case scenario, it may subject the corporate profits of the Home country entity to taxation in the employee’s temporary Host country. This can result in complex tax obligations and can potentially impact the financial stability of both the employer and the employee.

Ensuring tax compliance for digital nomads

While taking advantage of the opportunity to work in a foreign country for a limited period under a digital nomad visa is undoubtedly a very attractive proposition for many, it comes with numerous factors that both the individual employee and their employer must consider:

- Potential exposure to local income and social security taxes

- Cost and efforts associated with ensuring compliance including registering the individual and employer with local tax authorities

- Complications associated with calculating and remitting withholding tax

- Risk of creating a corporate permanent establishment in the Host country

- Impact of double tax treaties and totalization agreements (if they exist) in mitigating income tax and social security exposure

Staying informed and seeking professional guidance can help you navigate the complexities of digital nomads and ensure a successful and compliant international work experience for your employees.

As you explore the possibilities and challenges of offering your employees a digital nomad lifestyle, remember you don't have to navigate this journey alone—we're here to help you create a seamless and compliant experience for your employees. Schedule a call with our expert team and gain insights tailored to your specific mobility program needs.

The information provided in this article is for general informational purposes only and should not be construed as legal or financial advice. Always seek the advice of a qualified professional with any questions you may have regarding your situation.